nh meals tax form

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Big Companies Landed Paycheck Protection Program Loans And They Ll Be Back For More Shake Shack Shake Shack Burger Shack Burger

File this application with the municipality by the deadline see below.

. After that your nh meals and rooms tax form is ready. There is also a 85 tax on car rentals. For additional assistance please call the Department of Revenue Administration at 603 230-5920.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. File this form at least 30-days prior to the start of business or the expiration date of the existing license. Report all wages paid to part-time and temporary.

The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations. 603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. 2 NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION MEALS RENTALS TAX BOOKLET GENERAL INFORMATION MR General Info Rev 122015 FORM MR General Information MR TAX LICENSE REQUIREMENT The MR Tax is a tax assessed upon patrons of hotels restaurants and renters of motor vehicles based on the.

A Portsmouth New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. We last updated the 2013 Meals and Rentals Booklet in April 2021 and the latest form we have available is for tax year 2020. If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920.

Utility Property Tax. A restaurant that sells meals to a restaurant meal delivery company must accept a Massachusetts Sales Tax Resale Certificate Form ST-4 from that restaurant meal delivery company. The meals tax rate is 625.

MEALS RENTALS TAX RETURN Instructions Meals Rental Operators may file electronically on the Departments website at wwwrevenuenhgovgtc. A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year. NH DRA PO Box 454 Concord NH 03302-0454.

A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. Be sure to visit our website at revenuenhgovGTC to create your account access today. There are three variants.

In all likelihood the Application For Meals And Motor Vehicle Rentals Tax Operators License Form CD-3 is not the only document you should review as you seek business license compliance in. Select the document you want to sign and click Upload. The Meals and Rentals MR Tax was enacted in 1967.

Rentals Tax and follow the prompts. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served the holder of the license is. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

Beginning July 1 2019 an exemption under Act 51 applies to purchases of meals for the purpose of resale. The buyer must present to the seller an accurate and properly executed exemption. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Portsmouth New Hampshire Meals Tax.

Example line 10 Taxable wages 1400000 line 11 X UI Tax Rate 35 49000. Filing options - Granite Tax Connect. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax.

The tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants as well as on motor vehicle rentals. CHECK the AMENDED RETURN box if you are filing to make changes or corrections to a previously filed DP-14 for any ONE taxable period. NH DRA PO Box 454 Concord NH 03302-0454.

A typed drawn or uploaded signature. Follow the step-by-step instructions below to eSign your nh dp14. This means that we dont yet have the updated form for the current tax yearPlease check this page regularly as we will post the updated form as soon as it is released by the New Hampshire Department of Revenue Administration.

Decide on what kind of eSignature to create. A 9 tax is also assessed on motor vehicle rentals. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered.

Create your eSignature and click Ok. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. Once the buyer resells the meals it must collect and remit meals tax to the Department of Taxes.

We recommend that you obtain a Business License Compliance Package BLCP. A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT.

Tax Returns Payments to be Filed. WHERE TO FILE Mail to. The notice of tax means the date the board of tax and land appeals BTLA determines the.

Please visit GRANITE TAX CONNECT to create or access your existing account. A buyer intending to resell meals may purchase meals without paying meals tax to the seller. If you have questions call 603 230-5920.

This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as of January 1 2022. The MR Tax is paid by the consumer and is collected and remitted to the State on the 15th of each month by operators of hotels restaurants or other businesses providing. TOTAL TAX DUE - The total of lines 11 and 12 is the total tax due to the State of NH.

Once the form is accepted the restaurant doesnt have to collect and send the sales tax on meals to the Commonwealth. Payment on your FUTA form Line 13. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters.

Business Location New Hampshire State Licenses Meals Tax Restaurant Tax City Lodging And Restaurant Tax Form F10 Modify Search City Lodging And Restaurant Tax Form F10 In all likelihood the City Lodging And Restaurant Tax Form F10 is not the only document you should review as you seek business license compliance in. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. File this form at least 30-days prior to the start of business or the expiration date of the existing license.

Date of filing is the date this form is either hand delivered to the municipality postmarked by the post office or receipted by an overnight delivery service.

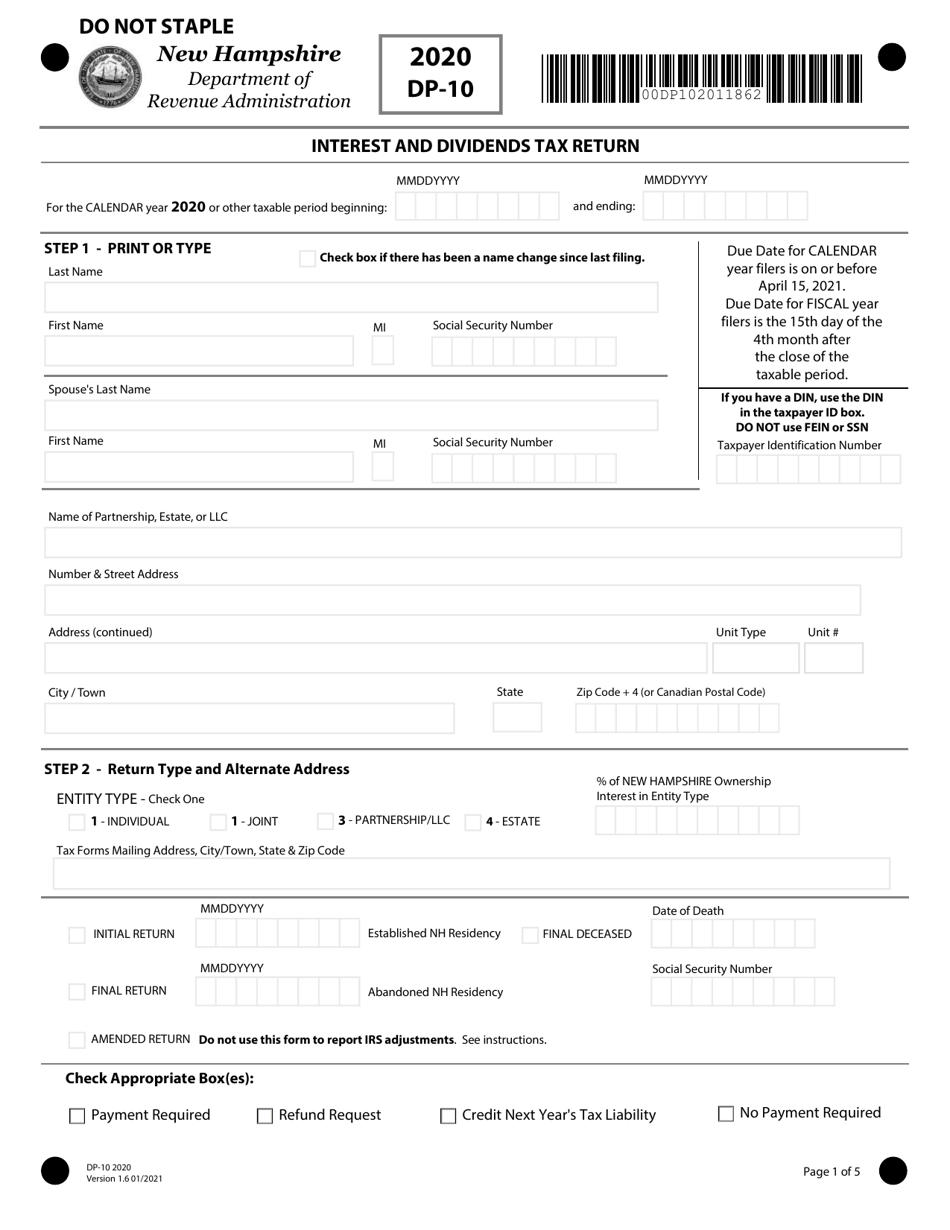

Form Dp 10 Download Fillable Pdf Or Fill Online Interest And Dividends Tax Return 2020 New Hampshire Templateroller

3 Things You Need To Know About The New Tax Code New Hampshire Public Radio

Hoss And Mary S In Maine Makes Incredible Burgers The Incredibles Maine Mary

Atlanta Georgia Personal Chef Personal Chef Business Personal Chef Chef Craft

Form St 810 8 11 New York State And Local Quarterly Sales And

Fillable Form 1040 Schedule C 2019 Irs Tax Forms Credit Card Statement Tax Forms

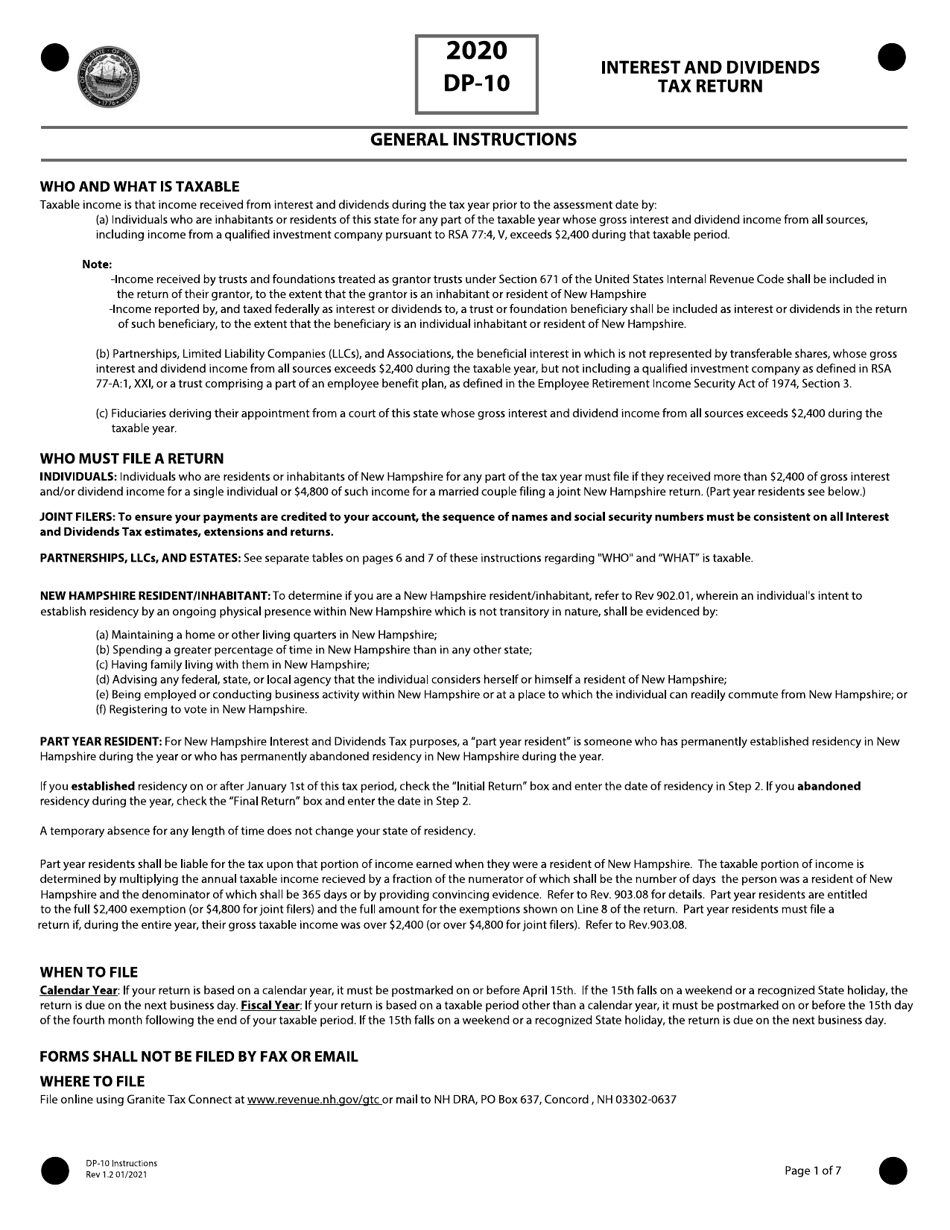

Download Instructions For Form Dp 10 Interest And Dividends Tax Return Pdf 2020 Templateroller

Nh Dor Dp 14 2019 2022 Fill Out Tax Template Online Us Legal Forms

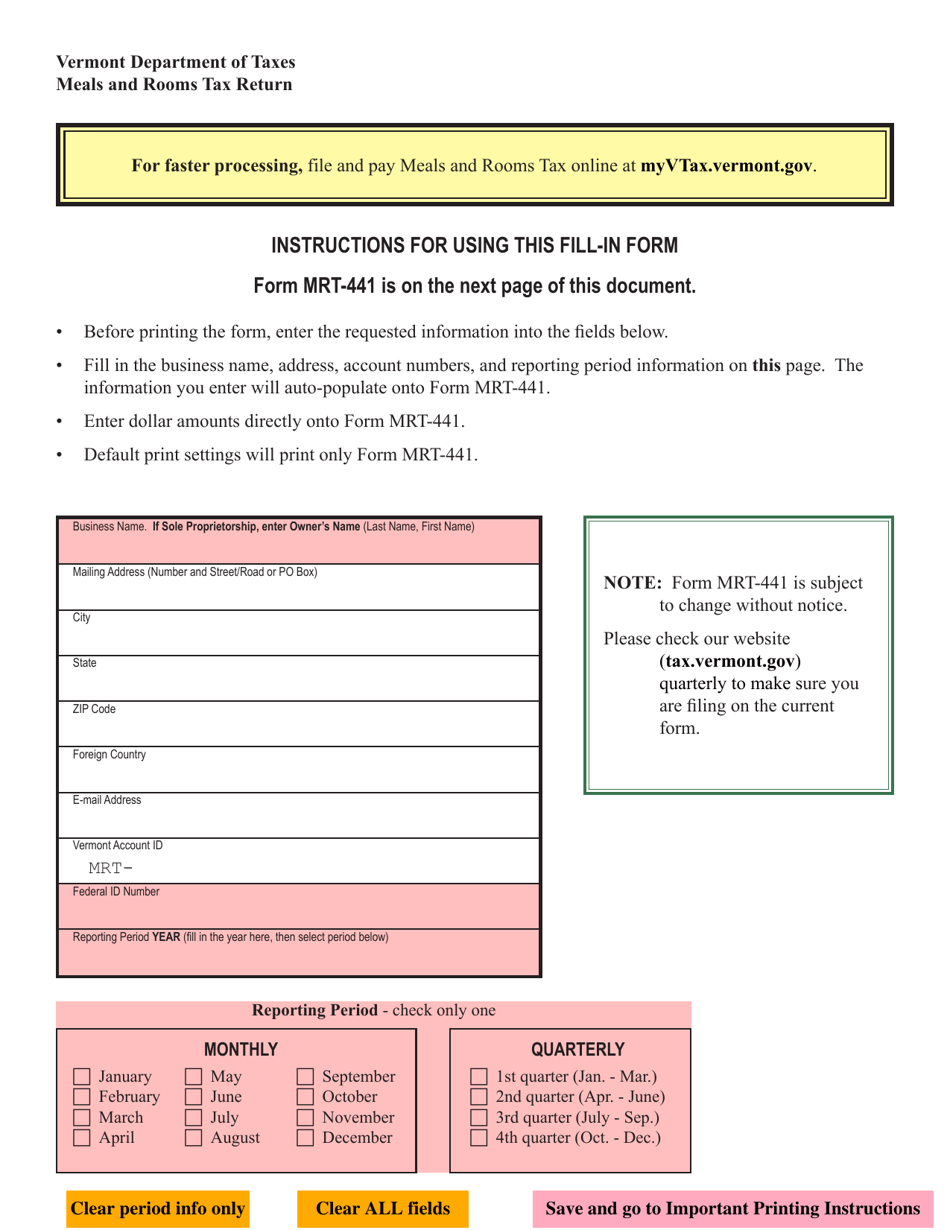

Vt Form Mrt 441 Download Fillable Pdf Or Fill Online Meals And Rooms Tax Return Vermont Templateroller

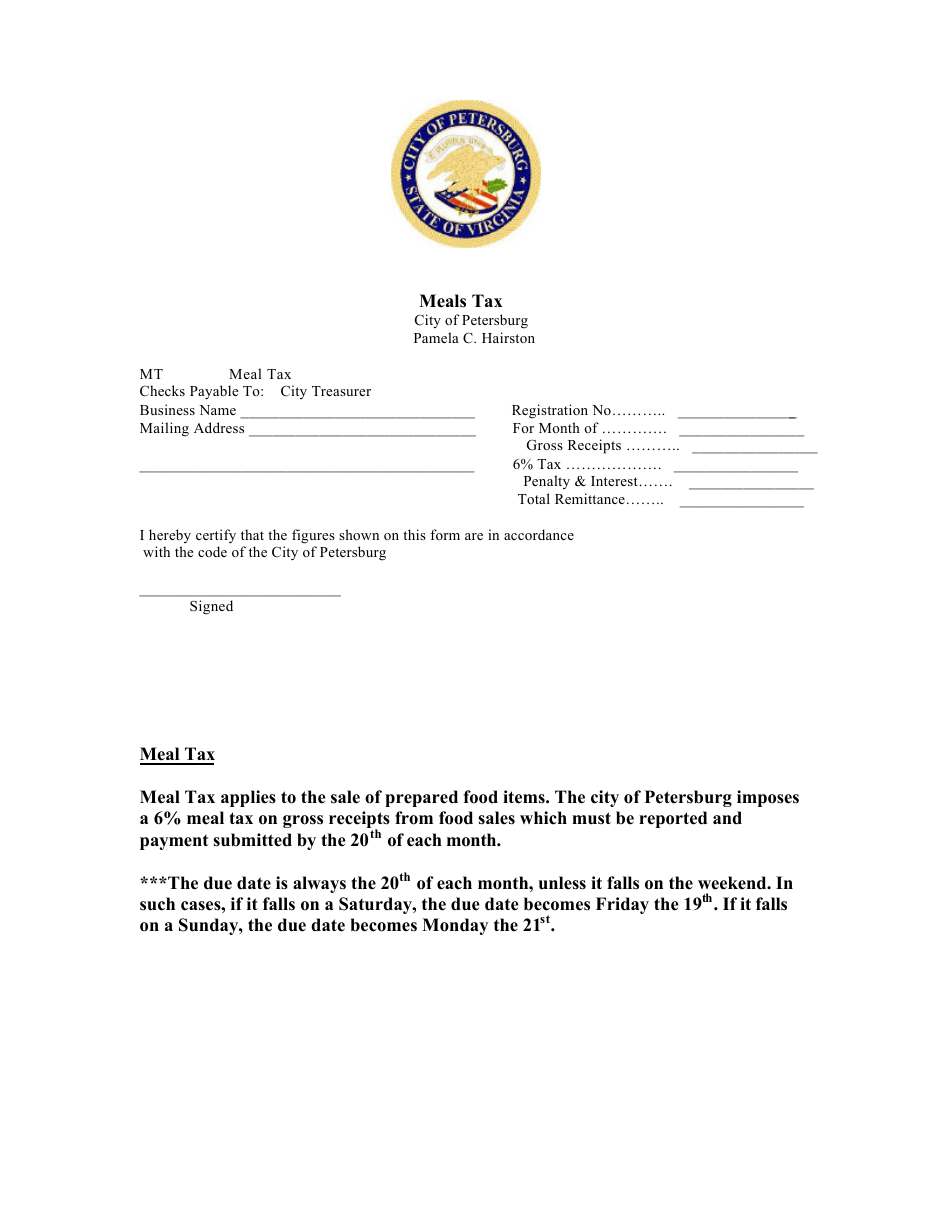

Petersburg Virginia Meals Tax Form Download Printable Pdf Templateroller

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

What I Learned Doing My Own Tax Return Real Advice Gal Tax Return Diy Taxes Income Tax Return

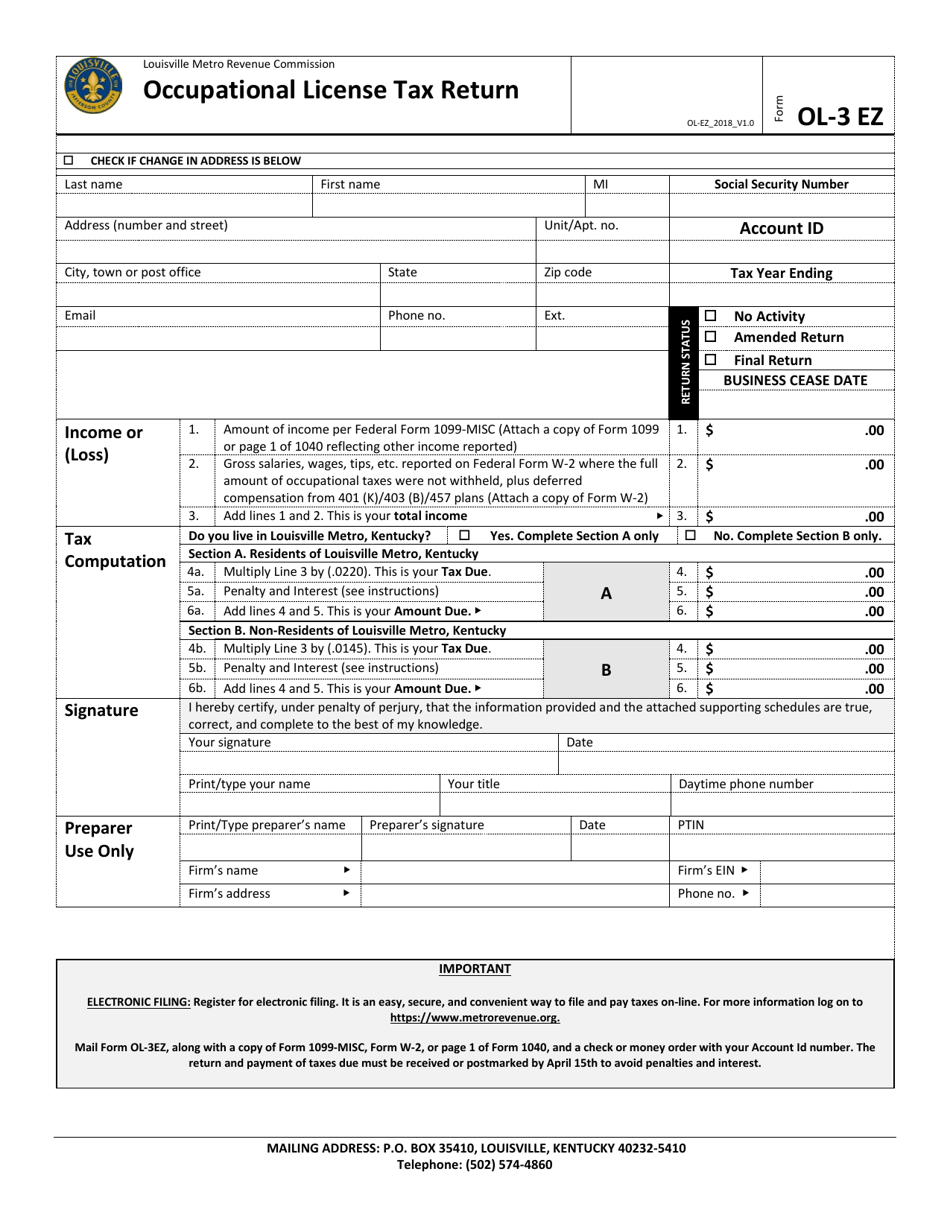

Form Ol 3 Ez Download Printable Pdf Or Fill Online Occupational License Tax Return Louisville Metro Kentucky Templateroller

Corporate Tax In The United States Wikiwand

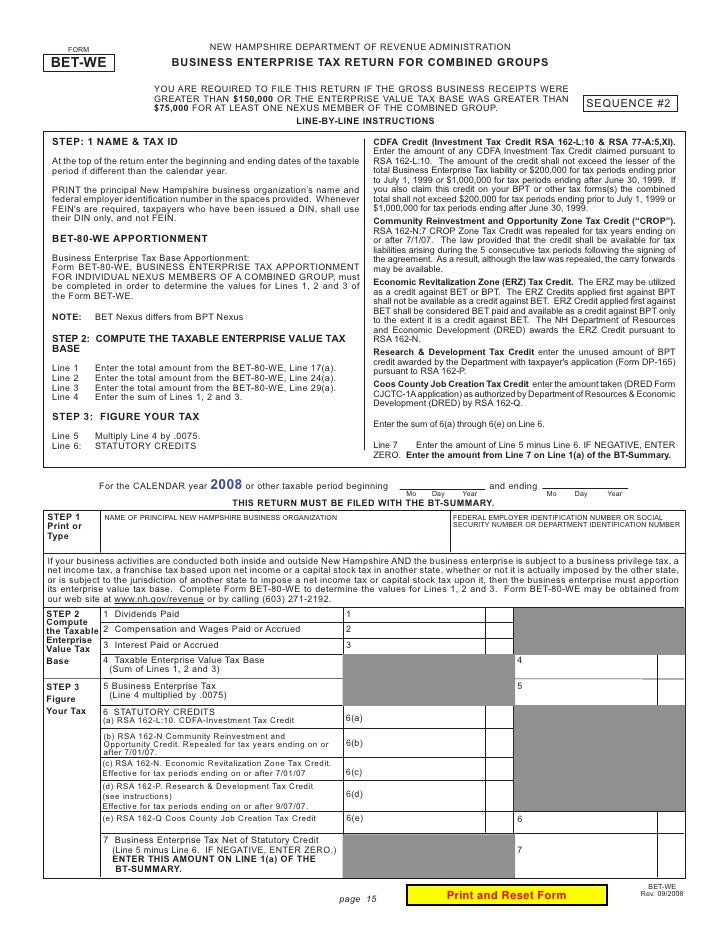

Combined Group Business Enterprise Tax Return

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040 I1040tt By Legibus Inc Issuu